Giỏ hàng hiện tại chưa có sản phẩm nào!

Danh mục: Bookkeeping

-

Are Salaries Considered Mounted Costs?

The key variations between fixed and variable costs lie of their stability, relationship to enterprise activity ranges, and controllability. By understanding these distinctions, small business homeowners can successfully manage each types of prices, optimize monetary efficiency, and make knowledgeable financial choices. Variable prices are any costs that change or fluctuate primarily based on an organization’s output. As such, the quantity of variable prices changes when manufacturing adjustments. Costs drop when production drops and, equally, costs rise when production increases.

Are Wages Fixed Or Variable Cost?

In Contrast To fastened costs, which remain fixed regardless of output, variable prices rise or fall as enterprise activity levels change. Understanding variable prices is crucial for small business house owners as these costs instantly impact the profitability of every unit produced or sold. To grasp labor prices more successfully, allow us to first distinguish between direct and indirect labor prices.

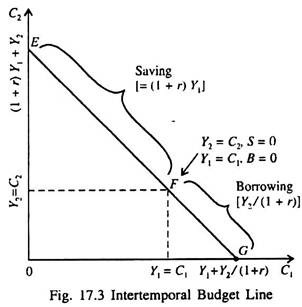

Mounted prices are bills that remain the identical irrespective of how much a company produces, corresponding to hire, property tax, insurance coverage, and depreciation. Variable costs are any bills that change based mostly on how a lot a company produces and sells, corresponding to labor, utility expenses, commissions, and raw supplies. By understanding and managing mounted and variable costs effectively, entrepreneurs can enhance financial stability and drive business development. A company’s breakeven analysis could be essential for selections that have to be made about fixed and variable prices.

What Is The Difference Between Variable And Fixed Costs?

In apply, a balanced compensation package deal that includes both fixed and variable components may be efficient. Take, for example, a marketing manager with a base salary of $70,000, a yearly bonus of up to 10% based on efficiency, and inventory options that vest over four years. This structure supplies a stable earnings whereas also providing the potential for added earnings based mostly on individual and firm success. Fixed prices are generally easier to plan, handle, and finances for than variable costs.

The breakeven evaluation additionally influences the price at which an organization chooses to sell its products. Corporations have some flexibility when breaking down prices on their financial statements, and glued costs may be allocated throughout their revenue assertion. The proportion of mounted to variable costs (and how they’re allocated) can depend upon its trade.

Variable prices are sometimes thought of to be more controllable than mounted prices since they are instantly influenced by administration selections and operational adjustments. By analyzing and managing variable prices successfully, businesses can optimize their value structure and improve profitability. In conclusion, salaries are thought of fastened prices because of their constant nature, which does not vary with production or gross sales quantity.

When a business has high fixed costs and low variable costs (meaning economies of scale), it can decrease prices to increase market share and sales volume. On the other hand, a business with low mounted prices and excessive variable costs might not profit significantly from economies of scale and will have to charge greater costs. Variable costs are expenses that change directly with the level of production. Examples embrace uncooked materials, direct labor, and transport costs.

Impact On Institutional Investors And Profitability

- General, wages embody elements of both fixed and variable prices.

- Fastened prices are expenses that remain constant regardless of your current gross sales revenue or spending.

- Wages paid to employees who usually are not instantly involved within the production process, such as office managers, would usually be included in administrative bills.

- A mounted value is a continuing expense—something you can predict every single time.

For instance, pension contributions are a type of deferred wage that have to be planned for over the lengthy term. Repeatedly evaluation revenue statements, steadiness sheets, and different monetary statements to make the mandatory changes and ensure that you do what’s greatest for your company at all times. A business can also have discretionary bills similar to gifts, holidays, and leisure prices.

The distinction between mounted and variable costs is crucial to know for your business’s future. Variable expenses are tied in to your business’s productivity. The amount of raw materials and inventory you purchase and the costs of shipping and delivery are all variable. The extra in demand your products are, the extra the costs go up. Fixed prices embrace lease, utilities, payments on loans, depreciation and promoting.

Fixed prices are normally established by contract agreements or schedules. Examples of mounted prices embrace rental lease funds, salaries, insurance, property taxes, curiosity bills, depreciation, and potentially some utilities. Understanding the difference between fixed and variable wage is important for higher financial planning and profession growth.

Not Like mounted prices, variable prices https://www.simple-accounting.org/ are directly related to the value of manufacturing of goods or services. Variable costs are generally designated as the price of goods offered (COGS), whereas fixed costs are not often (but can be) included in COGS. Fluctuations in sales and manufacturing levels can have an result on variable costs if factors similar to gross sales commissions are included in per-unit manufacturing costs. Meanwhile, fastened costs must nonetheless be paid even if manufacturing slows considerably.

-

“Loan” Vs “lend” In English

When it comes to obtaining funds or sources, the phrases “loan” and “lend” are often used interchangeably. Nevertheless, it’s important to grasp the distinction between these two words to ensure correct utilization. The borrower promises to repay the mortgage quantity, usually with interest, within a specified time frame. This debt could be formalized by way of a authorized settlement, similar to a mortgage contract, to make sure each events are protected.

Thus, the necessary thing distinction between “borrow” and “grant” lies within the nature of the transaction. Borrowing includes receiving a mortgage or an advance, which creates a debt that must be repaid. Granting, nonetheless, includes giving or bestowing one thing without any expectation of repayment. A mortgage refers again to the act of offering money or an asset to someone with the understanding that it is going to be repaid over time.

Advance: What Does It Mean?

In some circumstances, the lender may have the right to take authorized motion to gather the unpaid quantity. The key difference between mortgage and lend lies within the path of the transaction. Mortgage refers again to the motion of giving one thing to somebody for short-term use, whereas lend refers again to the act of providing something briefly to someone. In conclusion, the excellence between mortgage and lend is necessary to grasp to find a way to use every accurately. Whether Or Not you’re giving something to somebody or borrowing one thing from someone, understanding the distinction between mortgage and lend will allow you to communicate clearly and successfully.

By understanding each concepts, you can effectively navigate the world of debt and monetary transactions. When you lend cash to someone, you are basically providing them with a mortgage. This loan comes with an expectation that the borrower will repay the amount, normally with added curiosity. The lender may set phrases and situations for the loan, such as the compensation schedule, interest rate, and any extra charges.

It is important to grasp the legal variations between mortgage and lending to ensure compliance with applicable legal guidelines and regulations. Whether you would possibly be borrowing or offering monetary help, understanding the excellence can help protect your rights and pursuits in any financial transaction. Lending refers to the act of offering financial help or resources to someone else. It entails giving cash, property, or other assets to a different individual or entity, with the expectation that it is going to be returned in the future.

Mortgage Vs Lend: Key Similarities

In this case, “lend” functions as a verb, indicating that you are giving or permitting somebody to borrow cash. While lending is often used interchangeably with loaning, there’s a delicate difference between the 2 terms. Lending carries the connotation of an ongoing or steady process, while loaning suggests a one-time act of providing a mortgage. Lending is the act of giving another person the short-term use of cash or something else of value.

When granting, there is no requirement for the recipient to return the granted item or repay any quantity. On the opposite hand, an advance is just like a loan in that it entails giving somebody cash or valuables with the expectation of compensation. Nonetheless, an advance is typically offered in anticipation of future earnings or income, typically before it is truly earned. Advances are generally utilized in employment situations, where an employee could receive a portion of their salary prematurely to cowl instant expenses. On the opposite hand, when someone bestows cash to another person, they are giving or granting it with none expectation of compensation. The recipient of the bestow does not incur any debt or obligation to repay the quantity they obtain.

Lending and loaning contain the momentary switch of an merchandise or funds, with the expectation of compensation. Understanding the differences between giving, lending, and loaning might help you navigate the complexities of borrowing and lending. In abstract, debt encompasses the idea of borrowing and lending, the place one celebration lends or advances cash, items, or providers to another celebration. The borrower is then obligated to repay the loan quantity, whereas grants and advances may not require repayment. Proper understanding and management of debt are elementary for making informed financial selections.

Why Is ‘-ed’ Typically Pronounced At The Finish Of A Word?

No, they do not seem to be interchangeable; ‘loan’ is a noun, and ‘lend’ is a verb, so that they serve different grammatical features. His prohibition on the verb mortgage unfold far and extensive, even after his terrible etymologizing was debunked, and persists to varying levels right now. This in spite of the truth that the written record reveals that mortgage has frequently been used to discuss with issues for nearly four hundred years now. When you permit someone to use one thing for a quick time in return for cash, you additionally lease it.

Understanding the excellence between loaning and lending is crucial for making informed choices regarding private funds. Many folks often confuse these phrases, however there is a significant distinction between loan and lend. When it comes to negotiating loan https://www.simple-accounting.org/ agreements, it’s essential to grasp the distinction between lending and borrowing. Whereas the terms “loan” and “lend” are often used interchangeably, there is a subtle difference between the two. In summary, the distinction between loan and lend lies within the course of the transaction. Loaning entails giving one thing to someone, while lending includes offering one thing briefly.

- The lender has the possession and ownership of the item being lent, and the borrower is utilizing it briefly.

- The individual who owes money is considered the debtor, while the individual to whom the money is owed is the creditor.

- Understanding these cultural perspectives is important so as to navigate social interactions and keep away from misunderstandings.

- Lend is more frequent in everyday language, while mortgage is extra common in financial and authorized contexts.

- In this case, you’re the borrower and are obligated to make regular payments until the debt is fully repaid.

Lending, then again, involves providing someone with a resource, often money, beneath the settlement that it is going to be returned sooner or later. When you lend to somebody, you might be helping them briefly, allowing them to make use of your assets for a specific time period. Lending is often accomplished via formal agreements or contracts, outlining the terms and circumstances of repayment.

-

The Last Word Information To Bookkeeping For Independent Contractors Accounting

Ryan additionally beforehand oversaw the manufacturing of life science journals as a managing editor for publisher Cell Press. Have someone who understands your taxes take your data and do your taxes for you. It’s extra versatile than Quickbooks, it has a GPS app, and appears nicely designed. Keep tuned, I’ll be placing out a evaluate quickly after I’ve had more time to add info to it.

Correct financial data offers you a basis for planning and scaling. Whether Or Not you’re looking to rent help, invest in new tools, or set long-term goals, bookkeeping helps you assess whether you presumably can afford it and the means to allocate your sources wisely. Effective bookkeeping is an investment in your business’s success. By sustaining clear and correct financial records, you’ll have the ability to give consideration to rising your contracting enterprise with confidence.

Good bookkeeping means you’ll have all of your earnings and expenses organized when it’s time to file your taxes. This saves you time, stress, and doubtlessly cash (since you’re much less more doubtless to make mistakes). Maintaining track of taxable earnings is a crucial facet of bookkeeping for unbiased contractors.

Get A Bank Account Only For Your Business

Any impartial contractor’s understanding of their enterprise will improve with a transparent understanding of their financial scenario. They might be better outfitted to precisely pay their taxes to the IRS. Understanding their prices https://www.intuit-payroll.org/ may help them select how much to cost for his or her services. Hold all financial paperwork for a minimum of 7 years for taxes. Digital storage is convenient—scan receipts to cloud providers or your accounting software, with many apps providing mobile capture features.

Evaluation Before Taxes

Get free guides, articles, instruments and calculators that can assist you navigate the monetary aspect of your small business with ease. Keep up to date on the latest products and services anytime wherever. At Business.org, our research is meant to offer basic product and service recommendations. We do not guarantee that our ideas will work finest for each individual or business, so contemplate your unique wants when selecting services and products. Now that you’ve completed your Schedule C and Schedule SE, you’ve the income and deduction data you have to finish filing your 1040 private tax return.

Its $15 a month starting price is a bit greater than average, but if your business relies largely on invoices to receives a commission, give FreshBooks a tough look anyway. Companies don’t withhold taxes from impartial contractors’ paychecks. So, if you’re self-employed, you should figure out what to pay — and by when. We imagine everybody ought to have the power to make financial decisions with confidence.

Backup Your Knowledge

Every country has completely different laws concerning self-employed people and business homeowners. We advocate studying up in your local laws and rules or outsourcing it to a knowledgeable bookkeeper and/or accountant. Improper monetary planning tends to lead people into troublesome financial conditions. If you want to keep away from debt and experience monetary freedom, contemplate paying attention to your books.

BooXkeeping is a nationwide provider of reasonably priced outsourced bookkeeping services to small and medium-sized businesses. Numerous bookkeeping strategies can be found, together with guide, spreadsheet-based, and cloud-based bookkeeping software. When selecting a bookkeeping technique, it is very important contemplate your small business wants, the time and assets you may have obtainable, and your expertise with bookkeeping.

- Keep tuned, I’ll be putting out a review soon after I’ve had more time to add data to it.

- The correct financial assertion will increase the boldness of your investors and lender and can help you’ve access to cash circulate to fund necessary events.

- Need accounting software program that minimizes the amount of time you have to spend on finances?

- However, there are some tasks that have to be accomplished daily, like financial institution and credit card reconciliation.

- Placing your estimated tax payments in every month or each three months will allow you to avoid a tax bill that isn’t anticipated.

- A professional bookkeeper typically costs $30-$50 per hour, but many tradespeople find the expense properly worth it for the time saved and potential tax financial savings.

Impartial contractors can also have to pay state and local earnings tax. As of 2025, forty two states gather their very own revenue tax, according to the Tax Basis. Independent contractors can deduct half of their self-employment tax amount from their taxable income. This can lower your taxable income, but the self-employment tax itself remains to be an enormous expense.

Nevertheless, there are some duties that need to be accomplished day by day, like financial institution and credit card reconciliation. We take monthly bookkeeping off your plate and ship you your monetary statements by the fifteenth or 20th of each month. Reconciliation and account categorization are two examples of this. Bookkeepers notoriously struggle with proper categorizing of transactions, and these automations inside the software program permit you or your bookkeeper to be more efficient. That means they want reliable financial instruments that cowl the necessities, with out the hefty price ticket. If you’re the only working physique of a enterprise, you need software program that may make your life easier and simplify your finances.

-

Gross Pay vs Net Pay: How to Get Paychecks Right

If you earn gross income of $1,000 a week and $300 is taken out for taxes and other deductions, then your net income is $700. Net income, also known as net earnings, is the total revenue of a company minus operating costs. This includes the cost of goods, taxes, interest, operating expenses, selling, general and administrative expenses and depreciation. When preparing your taxes, it’s important to understand both figures. AGI is the starting point for calculating your tax bill, while net income helps you understand your actual take-home pay. Adjusted gross income (AGI) is calculated by taking your gross income and subtracting certain allowable deductions or adjustments.

What impacts net pay?

Once you understand the two terms and how to calculate each, you can perform manual calculations for payroll. net sales To save time and effort, you can check out QuickBooks Online Payroll solutions. For the hourly worker making $1,400 per paycheque, let’s say taxes and deductions are $400. After adding up your employee pension plan and benefits contributions, taxes, EI, and CPP, you get a total of $700.

- If you would like the calculator to calculate your gross wages, enter your hourly pay rate.

- This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice.

- You may also have other paycheck deductions that reduce your net income.

- So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck.

- FICA contributions are shared between the employee and the employer.

- To figure out your gross pay from your net pay, you have to know how much you paid in taxes, benefits and garnishments from a given paycheck.

Income Tax Brackets (due April

Usually, this change is 3% to 4%, but in 2023, it shot up to nearly 9% (from $147,000 to $160,200). That means the first $160,200 you earn in income will be taxed at the standard 6.2% rate, and every dollar you earn after that won’t incur the tax at all. Meanwhile, employer-enabled Roth IRA contributions are post-tax, meaning contributions won’t affect income and FICA taxes calculations.

- Understanding the key differences between gross and net pay supports accurate budgeting and financial planning.

- Our trusted brokers ensure the best outcomes for employees and employers by unlocking health savings and providing unrivaled plan options.

- For example, if you earn $13.50 an hour, you work 24 hours a week and you receive a paycheck every two weeks, your gross income per pay period is $648 (or $13.50 multiplied by 48 hours).

- If you’re paid hourly, and considering the minimum wage of Northern Ireland is £11.44 per hour, multiply your hourly rate by your weekly hours for your gross pay.

- In this section, we will walk into the standard deductions and withholdings.

Overview of Federal Taxes

No assurance is given that gross pay vs net pay the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published.

Adjust Calculator Width:

- It is important to note that not all income is subject to income tax.

- We dig into these in detail in how to calculate payroll, but here’s a quick overview.

- This figure is used to determine taxable income and employee benefits.

- Since you know the difference between gross and net pay, you can make sure that you are getting the right amount of money in your paycheck.

- Thomas says there are changes every year that affect net pay as the wage base for Social Security taxes is reevaluated on an annual basis.

- With Compensation Planning Software, you can manage compensation, bonuses, and equity plans all in one place.

If you’re looking to fund your small business, a clear view of your finances helps you understand what assistance you can receive. Contributions to retirement plans, such as a 401(k), typically come out of an employee’s gross pay, reducing their taxable income. Employer-matched contributions, if made on a pre-tax basis, do not impact an employee’s gross or net pay. They are included in an employee’s gross pay and reported on W-2 forms, with the necessary state and federal tax withholdings applied. Tocalculate your gross income before taxes, simply add up all sources of income,including your salary, bonuses, commissions, and any other forms ofcompensation.

-

Bookkeeping Cleanup Services Fix Your Financial Records

AccountsBalance is a monthly bookkeeping service specialized for agencies & SAAS companies. To use our bookkeeping services pricing calculator, you’ll need to prepare a couple pieces of information to enter into it. Understanding bookkeeping pricing is crucial because this ongoing expense can get out of control. This is why we not only recommend using a bookkeeping services pricing calculator, but have a free one on our website that you can use.

Make sure your chart of accounts is logical and clean

Regular bookkeeping cleanup ensures you stay audit-ready and tax-compliant all year round. Incomplete financial records increase the likelihood of incorrect entries, duplicate transactions, or unaccounted expenses. These errors can lead to compliance risks, affecting tax reporting and financial audits. Without a full record of income and expenses, you may also miss out on eligible deductions, resulting in higher tax liabilities.

Will Xenett help in this step?

Lastly, the expertise and reputation of the bookkeeping cleanup service provider can influence the pricing. Established professionals with a proven track record may charge higher fees due to their expertise and experience in handling complex cleanup projects. QuickBooks Live Expert Cleanup service (“Cleanup Service”) is only available during the current supported tax filing year.

- Yes, you can, especially if you have a good understanding of accounting principles and your business’s financial records are relatively straightforward.

- Mastering these processes is critical to navigating the financial landscape effectively and achieving business success.

- Historical bookkeeping clean-up is a systematic auditing procedure, focused on the detailed examination of every financial record from former financial periods.

- First, review accounts receivable aging report to ensure all outstanding invoices are recorded and tracked.

- There are several indications that an Bookkeeping clean-up may be required.

- Maanoj is Co-founder & Director of Growth Strategy & Alliance at Finsmart Accounting.

Bookkeeping Clean Up Services in Austin: Get Your Financials in Order

- Features like workflow automation, deadline tracking, client management, and billing can save you time, boost team collaboration, and keep your clients happy.

- Payment services are provided by Community Federal Savings Bank and Column National Association, to which Nium, Inc. acts as a service provider.

- Our 12-step guide and downloadable checklist transform the bookkeeping cleanup process from a daunting task into a manageable system for solopreneurs and small business owners alike.

- Secondly, the condition of your existing financial records plays a significant role in determining the pricing.

- Setting up folders for each month or categorizing by expense type can simplify organization.

- In the short run, you are deprived of valuable financial history, such as gross margins or customer acquisition costs, which are invaluable for planning.

It is saving businesses time and effort while improving and simplifying the once tedious process. With effective tools like Xenett, automation eliminates the risk of human error and simplifies financial processes within companies. Important tasks such as categorizing transactions, reconciling accounts, and creating reports have become seamless and efficient. Adopting bookkeeping clean up these technologies allows businesses to focus on strategic activities and decisions while maintaining a clear financial position.

A quick health check can help you figure out how financially fit your business is, while finding ways to improve it. Sorting out expenses can help you see where your money is going and identify ways to be a more profitable business. There are a couple of different ways that you can charge your client for a clean up. I will start by sharing the simplest way and the way I did it when I was first starting out. In all, clean ups are when you need to go into QuickBooks and fix a bunch of mistakes that have occurred over a period of time.

- It could also mean the clinic procurement department doesn’t have as many boxes of gloves as expected, so now management must pivot to avoid an interruption to everyday operations.

- Next, ensure all transactions are categorized consistently and accurately to avoid confusion later on.

- For one thing, it can make it very difficult to track your expenses and income, which can lead to problems come tax time.

- Accounting software offers the most robust features and automation, making it ideal for businesses with significant transaction volume or complex financial needs.

- Start small—like tackling one financial area each week—and be specific.

- Accounting cleanup is a series of adjustments to historical books to correct errors and improve the accuracy of financial statements.

- Important tasks such as categorizing transactions, reconciling accounts, and creating reports have become seamless and efficient.

Signs you need bookkeeping cleanup

Learn more about how FinOptimal can help you optimize your cash flow by exploring our Accruer software. Dealing with missing or incomplete records is a frequent headache during bookkeeping clean-ups. Maybe receipts are missing, invoices weren’t recorded, or bank statements are incomplete. Acuity’s insights on catch-up bookkeeping highlight the importance of a thorough review QuickBooks and organization process. You might need to contact clients or vendors to retrieve missing information, which can add time and complexity to the project. Developing a system for tracking down missing data is key to efficiently tackling this challenge.

Tax Preparation for Law Enforcement Officers: Deductions and Credits You Shouldn’t Miss

Connect with us via the contact form and get a detailed overview of our services from our executive. Start by reviewing double declining balance depreciation method your current financial statements, reports, and ledger. Here is a general workflow for completing a QuickBooks cleanup (thanks to insights from Veronica Wasek of 5 Minute Bookkeeping). Be sure to diagnose your client’s QuickBooks file to understand their issues and tailor your steps accordingly. Not every business model requires the company to deal with large stocks of inventory, but for those in the world of manufacturing, healthcare, and retail, reviewing inventory is vital.